| APPLICABLE COURSE | CA Inter Group 1 Combo (New Course)

Paper 1 : Advanced Accounts – By CA Parveen Sharma Paper 2 : Corporate & Other Laws By CA Ankita Patni Paper 3A : Direct Tax – By CA Bhanwar Borana Paper 3B : Indirect Tax – By CA Raj Kumar |

| KIT CONTENTS | Video Lectures + Study Materials (All Relevant Hard Copy Books) |

| APPLICABLE EXAM | May 2024 & Nov 2024 |

| NO. OF LECTURES |

Paper 1 : Advanced Accounts By CA Parveen Sharma – 240 Hours Paper 2 : Corporate & Other Laws By CA Ankita Patni – 180 Hours Paper 3A:-Direct Tax By CA Bhanwar Borana – 150 Hours Paper 3B: Indirect Tax By CA Raj Kumar – 105 Hours. |

| LECTURE DURATION |

Paper 1 : Advanced Accounts By CA Parveen Sharma – 90 Lectures. Paper 2 : Corporate & Other Laws By CA Ankita Patni – 70 Lectures. Paper 3A:-Direct Tax By CA Bhanwar Borana – 50-55 Lectures. Paper 3B: Indirect Tax By CA Raj Kumar – 38 Lectures. |

| VIDEO LANGUAGE | Hindi/English Mix |

| STUDY MATERIAL LANGUAGE | English |

| TOTAL VIEWS |

Advanced Accounts By CA Parveen Sharma – 1.5 times on duration every lecture. Corporate & Other Laws By CA Ankita Patni – 1.3 times per lecture. Taxation By CA Bhanwar Borana and CA Raj Kumar – 1.5 times on duration every lecture. |

| VALIDITY PERIOD |

Advanced Accounts By CA Parveen Sharma – 6 months from the date of activation Corporate & Other Laws By CA Ankita Patni – 6 months from the date of activation Taxation By CA Bhanwar Borana and CA Raj Kumar – IDT: 6 Months Validity | DT: 9 months from the date of activation |

| RUNS ON | Laptop |

| RECORDING | July-August 2023 |

| MODE | Google Drive |

| TECHNICAL SUPPORT | support@lecturekharido.com |

| DISPATCH TIME | Will Be Dispatched To The Address Within 24 Hours. |

| DELIVERY TIME | 5 – 10 Days From Date Of Order. |

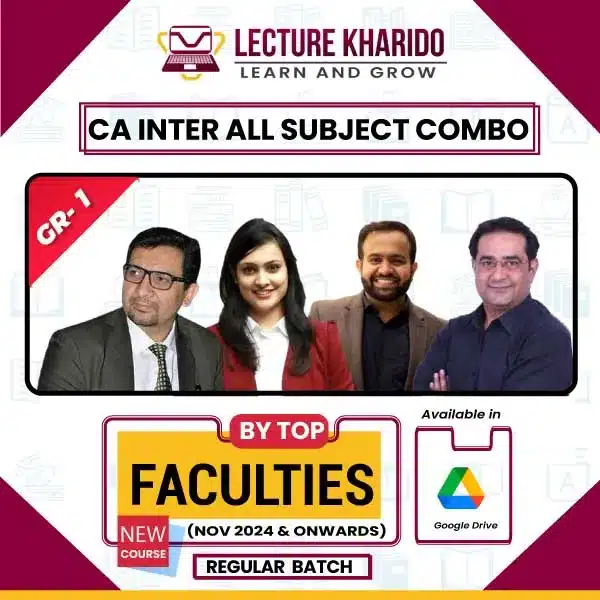

CA Inter Group 1 combo All Subjects – Regular Batch – For Nov 2024 & May 2025

₹46,200.00 Original price was: ₹46,200.00.₹34,100.00Current price is: ₹34,100.00.

CA Inter New Scheme Group 1 (Full Course Combo) By Top Faculties of India

Available in Google Drive Mode

Paper 1 : Advanced Accounts – By CA Parveen Sharma

Paper 2 : Corporate & Other Laws By CA Ankita Patni

Paper 3A : Direct Tax – By CA Bhanwar Borana

Paper 3B : Indirect Tax – By CA Raj Kumar

| CA Intermediate Subjects | CA Inter All subject Combo (New Course) |

|---|---|

| Faculties | Ankita Patni, Bhanwar Borana, Parveen Sharma, Raj Kumar |

| Advance Accounts | Parveen Sharma |

| Corporate & Other Laws | Ankita Patni |

| Direct Tax & Indirect tax | Bhanwar Borana & Raj Kumar |

| Batch Type | Regular |

| Mode | |

| Languages | English + Hindi |

CA Parveen Sharma is a first-class commerce graduate from Delhi University, has done his graduation from Sri Venkateswara College. He qualified for his Chartered Accountancy Course and was a rank holder in the Intermediate and Finals. He topped the Delhi University by scoring 100% in Accountancy. Parveen Sharma completed his post-graduation in Indian Accounting Standards and US GAAP in July 2007. He has been honored with the title of God of Accountancy by his students.

CA Ankita Patni is one of the prominent Faculty of Swapnil Patni Classes. She has taught thousands of students through live & Virtual platforms in a short span of 5 years. She believes in Conceptual Clarity with Cumulative revision. She is an excellent teacher and is hence the choice of thousands of students every year.

CA Bhanwar Borana plays multiple roles very effectively as a Guide, Teacher, Mentor, Motivator, and Friend to his students. Bhanwar Sir is the professor to go beyond the theoretical reading of the section and makes students solve practice problems in the class which puts the students to ease during the examinations.

CA RAJKUMAR is a dynamic & qualified Chartered Accountant. As a brilliant student and position holder at the Graduation & Post Graduation level, he has 12 years of teaching experience in the field of Indirect Taxation. He is a favorite amongst CA Student for the astute & insightful academic inputs provided by him and for his pleasing & endearing personality and lucid art of teaching.

Reviews

There are no reviews yet.